CENTURY 21 Briscoe Estates closes the chapter on an era of brand history

April 2025, Pickering, Ontario – A piece of CENTURY 21 Canada history comes to a close as CENTURY 21 Briscoe Estates officially closes its doors. Briscoe Estates first opened its doors in June 1977, and holds the distinction of being the first brokerage with the then fledging brand in Eastern Canada. Agents are transferring to CENTURY 21 Percy Fulton—another legacy franchise within the organization.

Anne Briscoe had been a real estate agent for a few years when her broker at the time sent her an article about the recent growth of the Century 21 brand. “They had some of the best training I’d ever seen,” she recalls, “they were doing well in Canada, and what interested me the most were the connections that came with franchising, it wasn’t something I’d had before. With the advertising help that they provided, it wasn’t hard for me to join!”

Ann climbed on board the ship that Founder U. Gary Charlwood, currently the Executive Chairman of CENTURY 21 Canada, was steering across the country. After a successful ten years with the brand, her husband decided to join the endeavour.

“We were attending one of the brand’s national conferences,” says Dick Briscoe, reflecting on his decades alongside his wife. “After seeing one of the speakers, I decided I had to get into real estate as well and since then we’ve had some great years and made some great memories with CENTURY 21 Canada.”

Anne’s first impression of U. Gary and his leadership team never wavered over the decades. “They were all wonderful people, knowledgeable about the industry, friendly to their network and knew their franchisees in and out.”

CENTURY 21 Briscoe Estates has served their community out of three offices with 360 salespeople. “We offered twice a week training and that brought in some really good people. But as the market changed in recent years, we decided to step back and let the company get smaller.”

The Briscoes passed the ownership of the company to their son, Rick a few years ago, and this year the time came for him to close the doors on the brokerage. “It’s such a different market now and the time was right,” he explains. “My priority is being in a strong selling position while we wait for the market to adjust closer to normal levels.”

CENTURY 21 Briscoes Estates operated in Pickering, Ajax and Highland Creek, ON. CENTURY 21 Canada will be celebrating the 50th anniversary of their brand next year.

Real Estate: Real Success Spotlight – Kristie Cavanagh

In this episode of the Real Estate: Real Success Spotlight Series, we highlight Kristie Cavanagh, a top-producing agent from CENTURY 21 Northern Choice Realty Ltd. Brokerage in Kenora, Ontario.

Kristie’s track record speaks for itself: she’s a Double CENTURION® award winner for the past three years, ranked among the Top 1% and Top 100 Agents in 2024, and was named CENTURY 21 Canada’s Sales Associate of the Year. Her commitment to excellence, strong systems, and client-focused approach have propelled her to the top of her field.

In this episode, Kristie shares the strategies that helped her build long-term success in a competitive market—from mindset and goal-setting to building client trust and using CENTURY 21 tools effectively. Her story is packed with insights that will motivate and inspire agents at every stage of their career.

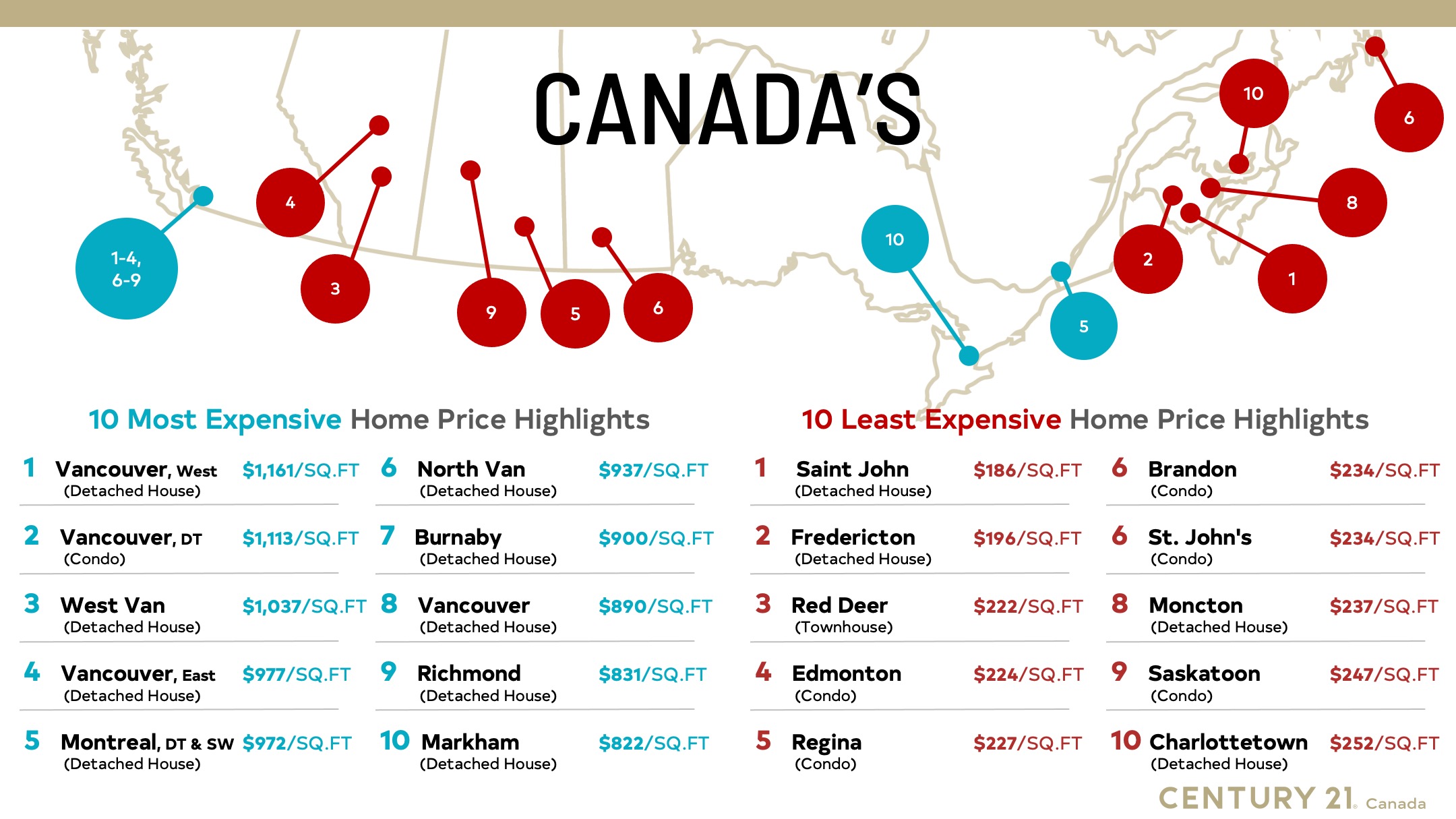

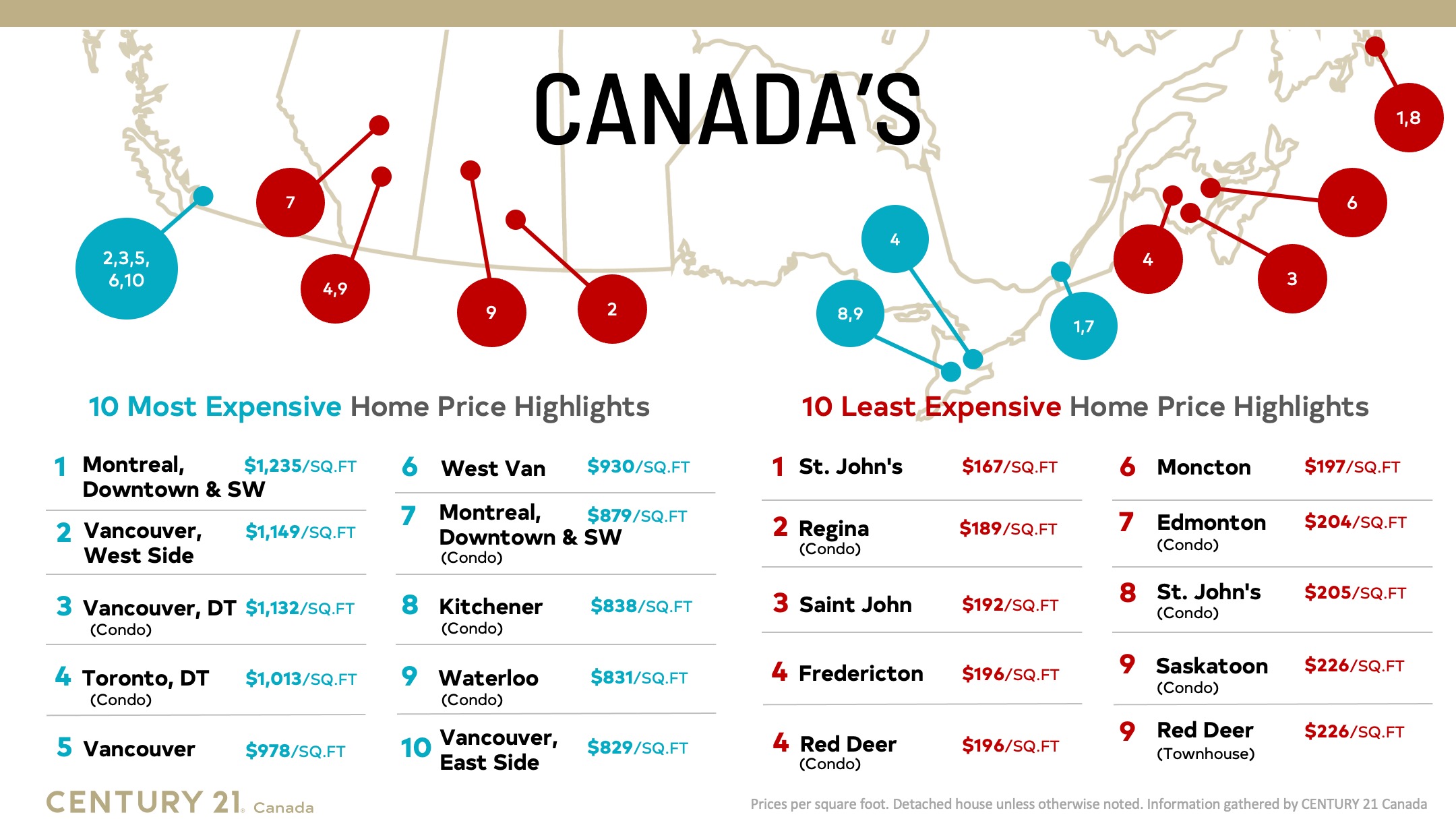

Price Per Square Foot Survey 2024

Canadian home prices largely stable, with some smaller communities, ‘burbs, and AB seeing increases

Annual Price per Square Foot survey looks at prices back to 2018 for almost 50 communities

Vancouver (July 22, 2024) – Canadian housing prices per square foot generally held steady in the first half of this year, with some notable exceptions indicating families continue to migrate to more affordable communities both nearby and across provincial borders.

CENTURY 21 Canada’s eighth annual Price per Square Foot survey compares the price per square foot of properties sold in almost 50 communities between January 1 and June 30 this year to the same period of previous years. In many cases it has data going back to 2018 for both metro centers and smaller communities.

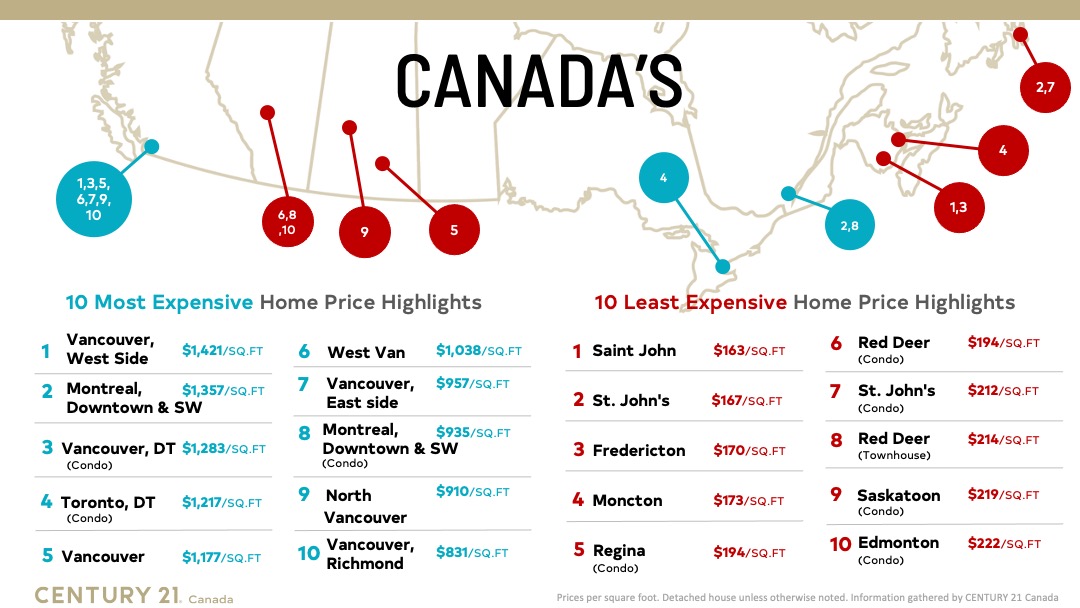

The report reveals that prices in Ontario, BC, and Atlantic Canada remained largely steady this year, with gains in some smaller markets and suburbs while downtown condo prices declined indicating continued migration away from metro cores. Alberta bucked the trend with significant price increases in a number of markets including Calgary and Edmonton – but to prices per square foot still well below those in BC, Quebec, and Ontario. The Prairies also saw price increases, but at a more modest pace.

Major city condo markets outside of Alberta all saw modest dips in price per square foot, while those in Alberta rose – by more than 17 per cent in Calgary and almost 10 per cent in Edmonton. Condo prices in High River topped the increases at more than 22 per cent, but to a relatively affordable $285 a square foot. That compares to $421 in Calgary (up 17.6 per cent), $1,113 in downtown Vancouver (down 1.7 per cent), $706 in downtown Toronto (down 4.5 per cent), and $672 in downtown Montreal (down 11.9 per cent). Vancouver continues to have the highest prices in Canada, while the Prairies and Atlantic Canada have the most affordable.

Looking back over the history of the survey, even with some declines over the last couple of years pricing has not fallen below 2021 levels in any included market. During COVID, 2021 saw significant price surges and set a new benchmark in markets coast-to-coast. For the most part, prices remain well above pre-COVID average.

Sales volumes across Canada have declined from the brisk market of 2021 and 2022, especially in larger cities.

“A number of our brokers are experiencing a slower market when compared to the conditions of just two years ago,” says Todd Shyiak, Executive Vice President of CENTURY 21 Canada. “While across the Prairies and Atlantic provinces the market is quite active and balanced, increasing inventory and hesitant buyers in the GTA and the lower mainland (Vancouver and area) are resulting in a ‘wait and see’ market. With the next possible rate cut coming on July 24th buyers may be extending their ‘wait and see’ approach until the fall.”

Shyiak says that inventory and interest rates will likely be major factors in prices going forward, as sellers may hold off on putting their homes on the market in response to a hesitant buyer base waiting for interest rates to fall.

“Ultimately, we don’t know what the next six months holds for our housing prices, but it’s important not to get too focused on any single year and look at each data point within the larger context of ever-evolving trends. That’s why this survey becomes more valuable year-over-year, because it allows us to see the big picture of Canadian housing.”

Regional highlights:

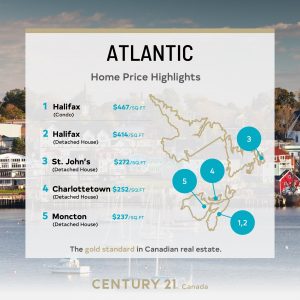

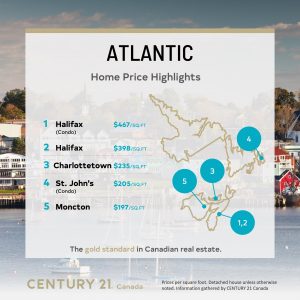

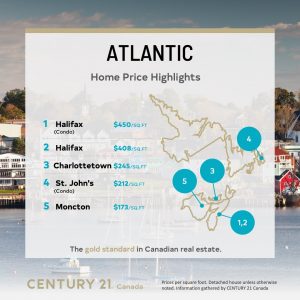

Atlantic Canada

Prices in Atlantic Canada have continued to see growth, but generally at a far more moderate pace compared to recent years. The sharp rise of Halifax condo prices seen in recent years stopped this year, with no change in price since last year. St. John’s, NL was an exception, with double-digit price growth continuing a steady upward trend that started in 2021. Moncton, NB also bucked this trend with a sharp 20 per cent rise in detached home prices, but to prices per square foot still among the lowest in Canada. Both are smaller markets feeling the boost of immigration both from abroad and within Canada. Along with the Prairies, Atlantic Canada continues to be the most affordable region in Canada, per square foot.

“We’re definitely feeling the change in the market, some areas of the region listing inventory is down while in others it is up. Prices are still trending up at various degrees and there are still families looking to make their home here,” says Joel Ives, Broker at CENTURY 21 Colonial Realty in Charlottetown. “I think we’re going to be able to weather these market conditions because we still have the advantage of affordability compared to the bigger markets.”

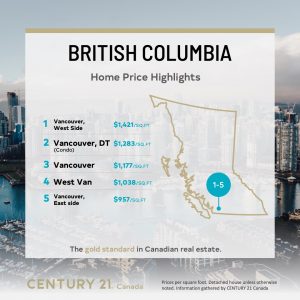

British Columbia

Though BC prices were stable overall for the first two-quarters of 2024 several Metro Vancouver suburbs saw price increases while Vancouver condo prices fell modestly, anecdotally due to families continuing to migrate from the city core to more affordable markets that offer more space. Vancouver east side houses went up almost 18 per cent in price to $977 per square foot, a rebound from a price decrease last year and well below the price per square foot of west side and downtown properties. West Vancouver, North Vancouver, Burnaby, Richmond, Delta, White Rock/South Surrey all saw increases this year as well – most of them modest, and a rebound from last year’s declines. Fraser Valley prices were stable.

In BC’s interior Kelowna’s market looks to have finally cooled after years of steady growth going back to 2019. Vernon is new to the report this year, with rates somewhat below those in Kelowna.

“A lot stayed the same this year, and it’s preferable to the alternative,” says CENTURY 21 Creekside owner Cameron Van Klei in Chilliwack. “We’re not seeing any signs of a huge turn, but it has been sluggish and we’re seeing the inevitable slowdown from the boom market of 2021.”

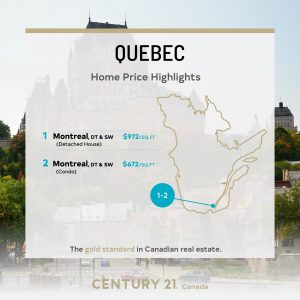

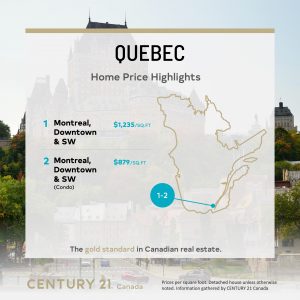

Quebec

After several years of sharp increases Montreal condo prices have declined by approximately 11 per cent. Conversely, detached homes have risen by a similar amount, which could tell a story of younger folks looking to upgrade to more space without moving out of the major metro area.

Ontario

Ontario was largely stable across the board, with the exception of a double-digit drop in Windsor detached house prices. That decrease follows a surge last year, returning the community to prices more in line with 2020 – 2022. The GTA saw little change, with the Toronto downtown condo market dipping by roughly 4.5 per cent. This drop builds on a sharp decline last year.

Sault Ste. Marie is new to the survey this year, and has the lowest PPSF for both condos and detached homes in the province. “We’re excited to see where the results of his survey take us,” says CENTURY 21 Choice Realty owner James Caicco in Sault Ste. Marie. “Our community is growing quickly and we’re sure that year-over-year trends will show just how many people have chosen to make Sault Ste. Marie their home.

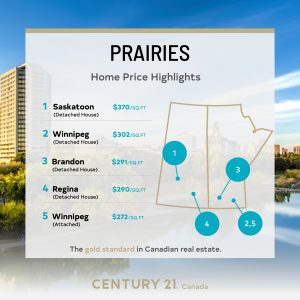

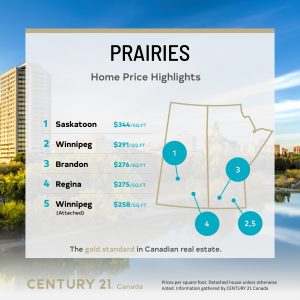

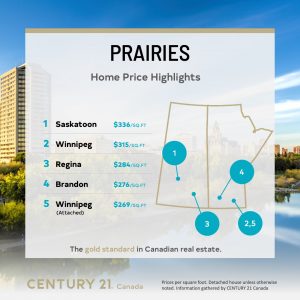

Prairies

Overall, prices in the prairies were up in the single digits. Condo prices rose as the larger cities in the region continue to grow, with Regina condos seeing the largest gain at 16 per cent with smaller gains throughout the rest of the province. Only Brandon condos trended downwards, but at a very modest 0.85 per cent. Prairie prices remain among the most affordable in Canada.

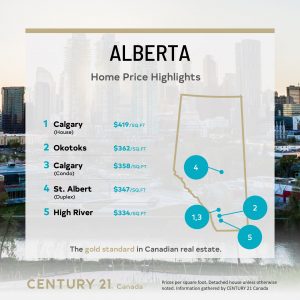

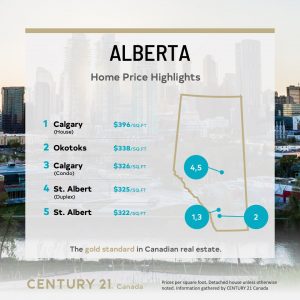

Alberta

Alberta bucked the national trend, with prices increasing briskly in numerous markets. Even with the increases Alberta prices remain well below those in neighboring BC, as well as Ontario and Quebec. The price increases tell a story of migration – Canadians moving to Alberta, in particular smaller communities where property prices remain moderate. Calgary prices continue to grow, with young professionals pushing condo prices up 17 per cent from last year.

CENTURY 21 Canada’s annual survey of data on the price per square foot (PPSF) of properties gathers and compares sales data from its franchises across Canada from January 1 to June 30 of each year. By looking at the price per square foot at the same time each year the firm is able to get a good idea of how prices have changed over time for similar properties. This year’s survey compares 2023 prices with this year’s results.

Price Per Square Foot Survey Results 2024

| ALBERTA | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | % Change from 2023 |

| Calgary | House | $341 | $325 | $320 | $355 | $396 | $419 | $470 | 12.17% |

| Calgary | Condo | $329 | $317 | $296 | $303 | $326 | $358 | $421 | 17.60% |

| Edmonton | Detached House | $288 | $272 | $268 | $284 | $297 | $309 | $317 | 2.59% |

| Edmonton | Duplex | $275 | $256 | $250 | $270 | $287 | $292 | $303 | 3.77% |

| Edmonton | Condo | $231 | $220 | $206 | $217 | $222 | $204 | $224 | 9.80% |

| High River | Detached House | $193 | $215 | $237 | $271 | $307 | $334 | $382 | 14.37% |

| High River | Condo | N/A | $241 | $173 | $176 | $223 | $233 | $285 | 22.32% |

| Okotoks | Detached House | N/A | $238 | $254 | $283 | $338 | $362 | $394 | 8.84% |

| Okotoks | Condo | N/A | $254 | $211 | $219 | $251 | $288 | $323 | 12.15% |

| Red Deer | Detached House | $276 | $262 | $252 | $289 | $293 | $294 | $325 | 10.54% |

| Red Deer | Townhouse | N/A | N/A | N/A | $207 | $214 | $226 | $222 | -1.77% |

| St. Albert | Detached House | $287 | $271 | $269 | $289 | $322 | $317 | $322 | 1.58% |

| St. Albert | Condo | $239 | $223 | $211 | $251 | $238 | $259 | $255 | -1.54% |

| St. Albert | Duplex | $262 | $272 | $278 | $280 | $325 | $347 | $301 | -13.26% |

| BRITISH COLUMBIA | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | % Change from 2023 |

| Chilliwack | Detached House | $297 | $294 | $288 | $406 | $515 | $419 | $427 | 1.91% |

| Chilliwack | Townhouse | $267 | $249 | $250 | $318 | $425 | $359 | $379 | 5.57% |

| Chilliwack | Condo/ Apartment | $283 | $290 | $270 | $351 | $473 | $443 | $437 | -1.35% |

| Kelowna | Detached House | $283 | $274 | $280 | $368 | $463 | $413 | $417 | 0.97% |

| Kelowna | Half Duplex | $247 | $260 | $263 | $320 | $402 | $362 | $393 | 8.56% |

| Kelowna | Townhouse | $292 | $287 | $302 | $365 | $452 | $422 | $422 | 0.00% |

| Kelowna | Apartment | $345 | $348 | $334 | $411 | $526 | $491 | $482 | -1.83% |

| Vancouver | Detached House | $856 | $769 | $816 | $975 | $1,177 | $978 | $890 | -9.00% |

| Vancouver, Downtown | Condo | $856 | $769 | $1,060 | $1,053 | $1,133 | $1,132 | $1,113 | -1.68% |

| Vancouver, East side | Detached House | $721 | $647 | $672 | $877 | $957 | $829 | $977 | 17.85% |

| Vancouver, West Side | Detached House | $1,147 | $990 | $1,004 | $1,208 | $1,421 | $1,149 | $1,161 | 1.04% |

| Burnaby | Detached House | $599 | $551 | $579 | $688 | $795 | $879 | $900 | 2.39% |

| West Van | Detached House | $899 | $738 | $734 | $971 | $1,038 | $930 | $1,037 | 11.51% |

| Richmond | Detached House | $677 | $598 | $608 | $722 | $831 | $773 | $831 | 7.50% |

| Delta North | Detached House | $423 | $400 | $413 | $570 | $716 | $594 | $618 | 4.04% |

| North Vancouver | Detached House | $681 | $613 | $690 | $794 | $910 | $817 | $937 | 14.69% |

| White Rock/South Surrey | Detached House | $506 | $472 | $435 | $625 | $795 | $627 | $724 | 15.47% |

| Victoria | Detached House | N/A | N/A | N/A | $558 | $592 | $602 | $567 | -5.81% |

| Victoria | Townhouse | N/A | N/A | N/A | $457 | $583 | $553 | $452 | -18.26% |

| Victoria | Condo | N/A | N/A | N/A | $659 | $676 | $723 | $694 | -4.01% |

| ATLANTIC | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | % Change from 2023 |

| Charlottetown | Detached House | $147 | $165 | $178 | $211 | $245 | $235 | $252 | 7.23% |

| Fredericton | Detached House | N/A | $99 | $123 | $147 | $170 | $196 | $196 | 0.00% |

| Halifax | Detached House | $155 | $162 | $170 | $281 | $408 | $398 | $414 | 4.02% |

| Halifax | Condo | $228 | $239 | $270 | $291 | $450 | $467 | $467 | 0.00% |

| Moncton | Detached House | $101 | $106 | $124 | $142 | $173 | $197 | $237 | 20.30% |

| Saint John | Detached House | N/A | $111 | $123 | $134 | $163 | $192 | $186 | -3.13% |

| St. John’s | Detached House | N/A | $132 | $135 | $149 | $167 | $167 | $272 | 62.87% |

| St. John’s | Condo | N/A | $174 | $116 | $182 | $212 | $205 | $234 | 14.15% |

| PRAIRIES | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | % Change from 2023 |

| Regina | Detached House | $254 | $246 | $237 | $250 | $284 | $275 | $290 | 5.17% |

| Regina | Condo | $236 | $213 | $205 | $205 | $194 | $189 | $227 | 16.74% |

| Saskatoon | Detached House | $270 | $263 | $263 | $314 | $336 | $344 | $370 | 7.03% |

| Saskatoon | Condo | $208 | $213 | $217 | $216 | $219 | $226 | $247 | 8.50% |

| Winnipeg | Detached House | $282 | $243 | $244 | $293 | $315 | $291 | $302 | 3.64% |

| Winnipeg | Condo | $261 | $220 | $223 | $234 | $254 | $249 | $271 | 8.12% |

| Winnipeg | Attached | N/A | $202 | $210 | $241 | $269 | $258 | $272 | 5.15% |

| Brandon | Detached House | $248 | $246 | $248 | $271 | $276 | $276 | $291 | 5.15% |

| Brandon | Condo | $196 | $204 | $204 | $203 | $243 | $236 | $234 | -0.85% |

| ONTARIO | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | % Change from 2023 |

| Barrie | Detached House | $283 | $350 | $350 | $378 | $503 | $576 | $579 | 0.52% |

| Bradford | Detached House | $286 | $345 | $358 | $410 | $580 | $535 | $530 | -0.93% |

| Cambridge | Detached House | $332 | $355 | $388 | $450 | $625 | $568 | $568 | 0.00% |

| Cambridge | Condo | $344 | $347 | $367 | $435 | $716 | $514 | $530 | 3.11% |

| Cambridge | Townhouse | $282 | $317 | $341 | $474 | $616 | $490 | $500 | 2.04% |

| Grey Bruce | Detached House | $175 | $182 | $195 | $357 | $455 | $406 | $415 | 2.22% |

| Guelph | Detached House | $397 | $409 | $443 | $483 | $690 | $627 | $618 | -1.44% |

| Guelph | Condo | $374 | $402 | $423 | $511 | $777 | $482 | $480 | -0.41% |

| Guelph | Duplex | $348 | $362 | $400 | $451 | $648 | $523 | $525 | 0.38% |

| Guelph | Townhouse | $311 | $335 | $364 | $433 | $641 | $580 | $573 | -1.21% |

| Hamilton | Detached House | $362 | $378 | $406 | $532 | $553 | $523 | $509 | -2.68% |

| Hamilton | Townhouse | $257 | $350 | $343 | $453 | $538 | $508 | $507 | -0.20% |

| Kitchener | Detached House | $339 | $359 | $400 | $430 | $618 | $610 | $605 | -0.82% |

| Kitchener | Townhouse | N/A | $323 | $342 | $435 | $576 | $487 | $490 | 0.62% |

| Kitchener | Condo | $328 | $362 | $399 | $483 | $800 | $516 | $491 | -4.84% |

| London | Detached House | $191 | $237 | $250 | $362 | $466 | $466 | $463 | -0.64% |

| Markham | Detached House | N/A | N/A | $485 | $557 | $685 | $841 | $822 | -2.26% |

| Niagara Falls | Detached House | N/A | $275 | $300 | $390 | $531 | $514 | $505 | -1.75% |

| Newmarket | Detached House | N/A | $372 | $510 | $505 | $516 | $704 | $693 | -1.56% |

| Ottawa | Detached House | $225 | $258 | $313 | $429 | $465 | $587 | $607 | 3.41% |

| Ottawa | Townhouse | N/A | N/A | N/A | $392 | $451 | $566 | $534 | -5.65% |

| Ottawa | Condo | $442 | $485 | $577 | $479 | $583 | $538 | $550 | 2.23% |

| Owen Sound | Detached House | $145 | $158 | $167 | $312 | $380 | $361 | $362 | 0.28% |

| Richmond Hill | Detached House | $445 | $465 | $522 | $520 | $665 | $813 | $806 | -0.86% |

| Sault Ste. Marie | Detached House | $298 | |||||||

| Sault Ste. Marie | Condo | $328 | |||||||

| St. Catharines | Detached House | $310 | $290 | $330 | $400 | $612 | $528 | $523 | -0.95% |

| Toronto, Downtown | Condo | $903 | $994 | $1,083 | $956 | $1,217 | $739 | $706 | -4.47% |

| Vaughn | Detached House | $434 | $503 | $548 | $612 | $695 | $772 | $776 | 0.52% |

| Waterloo | Detached House | N/A | $372 | $407 | $421 | $613 | $603 | $601 | -0.33% |

| Waterloo | Townhouse | N/A | $324 | $344 | $408 | $641 | $486 | $489 | 0.62% |

| Waterloo | Condo | N/A | $402 | $411 | $503 | $777 | $525 | $498 | -5.14% |

| Windsor | Detached House | N/A | $372 | $407 | $295 | $306 | $469 | $364 | -22.39% |

| QUEBEC | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | % Change from 2023 |

| Montreal, Downtown and SW | Condo | $567 | $709 | $805 | $935 | $935 | $763 | $672 | -11.93% |

| Montreal, Downtown and SW | Detached House | $603 | $674 | $958 | $1,350 | $1,357 | $880 | $972 | 10.45% |

Price Per Square Foot Survey 2023

Interest rate hikes prompt modest decline in Canadian home prices, but no freefall in sight, impact uneven

Vancouver (Aug 2, 2022) – Canadian housing prices have fallen with rising interest rates, but when looking back over even just two years remain on a long-term upward trend. Even then, the situation is uneven. The hot housing markets of the biggest city centres are seeing lower condo prices but smaller markets are seeing price per square foot growth, especially in single-family homes. Alberta bucked the trend and experienced price increases in many markets this year, while other Prairie provinces held steady. BC saw the most significant price declines.

The seventh annual Price per Square Foot survey is being released by CENTURY 21 Canada, comparing the price per square foot of properties sold between January 1 and June 30 this year to the same period of previous years.

Notably, most markets that did experience price declines from last year remained roughly equivalent to their 2021 benchmarks and well above earlier years. This year’s survey offers data going back to 2018 for numerous communities coast-to-coast.

“We knew that the market had to come down from the highs of the last few years, and we’re now fully seeing the effects of the interest rate growth that started last year,” says Todd Shyiak, Executive Vice President of CENTURY 21 Canada. “But we have to look at these numbers within the larger context. The fact that we haven’t dipped to pre-pandemic levels shows that homes are still in demand, and we continue to see growth in smaller markets as more families seek a lower cost of living.”

Prices had reached low points in January but steadily climbed over the spring, though many markets didn’t manage to regain their 2022 levels. Condos in Vancouver, Toronto and Montreal all saw declines, while detached homes across small Ontario cities rose, as did those in Atlantic Canada, indicating families seeking space. New Brunswick is emerging as a leader in Atlantic Canadian growth. Results from the 2021 census showed that Moncton, Fredericton and St. John are seen as popular locations for immigrants, and the results from this year’s PPSF survey indicate that trend has continued.

Shyiak says that inventory will play a major factor in prices going forward, as sellers may hold off on putting their homes on the market in response to a hesitant buyer base. “Ultimately, we don’t know what the next six months holds for our housing prices, but it’s important not to get too focused on any single year and look at each data point within the larger context of ever evolving trends. That’s why this survey becomes more valuable year-over-year, because it allows us to see the big picture of Canadian housing.”

Regional highlights:

Atlantic Canada

Prices in Atlantic Canada have continued to rise as Canadians from expensive urban markets seek a lower cost of living. For the first year since this survey started Halifax has lost its crown as the market with the steepest rise as condos in that city saw the smallest increase in the region after a sharp double-digit increase last year. Detached homes in Fredericton, Moncton and St. John’s all saw double-digit increases.

“Families are finding this to be a great place to settle down. We’ve been seeing these trends for years but post-2020 is when it really took off,” says Paul Burns, Manager at CENTURY 21 A&T Countryside Realty. “Interest rates may have slowed the market down slightly, but I’m confident New Brunswick especially will continue to grow.”

British Columbia

The steep prices throughout BC seem to have finally reached their cooling point, with the province seeing the steepest price declines but generally to levels still at or above those from 2021. Even then, Vancouver boasts some of the most expensive price per square foot dwellings in Canada, and prices of both detached houses and condos in the surrounding suburbs remain comparatively high.

Cities farther from the metropolitan core such as Chilliwack and Kelowna have also seen dips, though prices climbed throughout the spring to remain above 2021 levels. The only BC region to see growth was Victoria, possibly indicating more Lower Mainlanders searching across the water for cheaper real estate.

Quebec

Like the other Canadian metropolises, Montreal saw a dip in the price of condos and detached homes, but unlike Vancouver and Toronto the decline was modest and in the single digits. “A lot of young buyers like Montreal, and that’s helped keep the markets here relatively stable,” says Mohamad Al-Hajj, owner of CENTURY 21 Immo-Plus. “We’ll keep an eye on how the rest of the year goes, but it does look like things will remain steady.”

Ontario

Canada’s most populous province saw a wide range of change throughout, from declines to rises all over the map. Toronto condos remain expensive at a PPSF of $1,013, though this is a 16 per cent drop from 2022 to a level roughly in line with 2021 and 2020 prices. However, cities like Niagara Falls and Cambridge saw their family home types gain in the double-digits, and they lead an overall trend of cities farther away from the GTA seeing growth in the price of single-family homes.

“The trend of families looking for space away from the downtown core continues,” says Eryn Richardson, owner of CENTURY 21 Heritage Group. “The changing interest rates definitely had an impact on the prices as buyers are more hesitant, but no single market has fallen dramatically and we’re still seeing a lot of growth.”

Prairies

The Prairies have remained relatively steady with minor gains and losses across the board. Saskatoon detached homes lead the pack at a PPSF of $344, a testament to families who come to the region for space and lower costs. Winnipeg, Brandon and Regina continue the trend, seeing their detached single family homes at $291, $276 and $275 respectively. The most significant decline was in Winnipeg, but even there detached homes fell just 7.62 per cent in price per square foot – the moderate change reflecting the stability of the region.

Alberta

Overall, Alberta has seen the most growth over the past year, with consistent price per square foot gains in most markets. Growth was modest but steady over the first half of 2023, and regions that saw declines dipped no further than 2020 levels. Edmonton condos were among those to decline, a potential sign of younger and newer buyers being affected by rising interest rates.

However, condos in Okotoks rose 14 per cent in price, a good indication that smaller towns still have the potential to grow fast as buyers explore new options. Just north, Calgary saw a rise of 5.81 per cent in single-family homes and 9.82 per cent in condos, while Red Deer was largely unchanged.

“Alberta has really emerged as a viable option for a lot of buyers who are leaving the more expensive areas of BC. Buyers both young and established are finding homes that fit their needs,” says George Bamber, owner of CENTURY 21 Bamber Realty. “Not only are they getting cheaper housing, but they’re also finding vibrant and fast-growing communities that they can make their own.”

CENTURY 21 Canada’s annual survey of data on the price per square foot (PPSF) of properties gathers and compares sales data from its franchises across Canada from January 1 to June 30 of each year. By looking at the price per square foot at the same time each year the firm is able to get a good idea of how prices have changed over time for similar properties. This year’s survey compares 2022 prices with this year’s results.

See the full PPSF study results below.

| ALBERTA | House Type | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | % Change from 2022 |

| Calgary | House | $341 | $325 | $320 | $355 | $396 | $419 | 5.81% |

| Calgary | Condo | $329 | $317 | $296 | $303 | $326 | $358 | 9.82% |

| Edmonton | Detached House | $288 | $272 | $268 | $284 | $297 | $309 | 4.04% |

| Edmonton | Duplex | $275 | $256 | $250 | $270 | $287 | $292 | 1.74% |

| Edmonton | Condo | $231 | $220 | $206 | $217 | $222 | $204 | -8.11% |

| High River | Detached House | $193 | $215 | $237 | $271 | $307 | $334 | 8.79% |

| High River | Condo | N/A | $241 | $173 | $176 | $223 | $233 | 4.48% |

| Okotoks | Detached House | N/A | $238 | $254 | $283 | $338 | $362 | 7.10% |

| Okotoks | Condo | N/A | $254 | $211 | $219 | $251 | $288 | 14.74% |

| Red Deer | Detached House | $276 | $262 | $252 | $289 | $293 | $294 | 0.34% |

| Red Deer | Townhouse | N/A | N/A | N/A | $207 | $214 | $226 | 5.61% |

| Red Deer | Condo | N/A | N/A | N/A | $186 | $194 | $196 | 1.03% |

| Red Deer | Duplex | N/A | N/A | N/A | N/A | $269 | $264 | -1.86% |

| St. Albert | Detached House | $287 | $271 | $269 | $289 | $322 | $317 | -1.55% |

| St. Albert | Condo | $239 | $223 | $211 | $251 | $238 | $259 | 8.82% |

| St. Albert | Duplex | $262 | $272 | $278 | $280 | $325 | $347 | 6.77% |

| BRITISH COLUMBIA | House Type | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | % Change from 2022 |

| Chilliwack | Detached House | $297 | $294 | $288 | $406 | $515 | $419 | -18.64% |

| Chilliwack | Townhouse | $267 | $249 | $250 | $318 | $425 | $359 | -15.53% |

| Chilliwack | Condo/ Apartment | $283 | $290 | $270 | $351 | $473 | $443 | -6.34% |

| Kelowna | Detached House | $283 | $274 | $280 | $368 | $463 | $413 | -10.80% |

| Kelowna | Half Duplex | $247 | $260 | $263 | $320 | $402 | $362 | -9.95% |

| Kelowna | Townhouse | $292 | $287 | $302 | $365 | $452 | $422 | -6.64% |

| Kelowna | Apartment | $345 | $348 | $334 | $411 | $526 | $491 | -6.65% |

| Vancouver | Detached House | $856 | $769 | $816 | $975 | $1,177 | $978 | -16.91% |

| Vancouver, Downtown | Condo | $856 | $769 | $1,060 | $1,053 | $1,133 | $1,132 | -0.09% |

| Vancouver, East side | Detached House | $721 | $647 | $672 | $877 | $957 | $829 | -13.38% |

| Vancouver, West Side | Detached House | $1,147 | $990 | $1,004 | $1,208 | $1,421 | $1,149 | -19.14% |

| Burnaby | Detached House | $599 | $551 | $579 | $688 | $795 | $725 | -8.81% |

| West Van | Detached House | $899 | $738 | $734 | $971 | $1,038 | $930 | -10.40% |

| Vancouver, Richmond | Detached House | $677 | $598 | $608 | $722 | $831 | $773 | -6.98% |

| Delta North | Detached House | $423 | $400 | $413 | $570 | $716 | $594 | -17.04% |

| North Vancouver | Detached House | $681 | $613 | $690 | $794 | $910 | $817 | -10.22% |

| White Rock/South Surrey | Detached House | $506 | $472 | $435 | $625 | $795 | $627 | -21.13% |

| Victoria | Detached House | N/A | N/A | N/A | $558 | $592 | $602 | 1.69% |

| Victoria | Townhouse | N/A | N/A | N/A | $457 | $583 | $553 | -5.15% |

| Victoria | Condo | N/A | N/A | N/A | $659 | $676 | $723 | 6.95% |

| ATLANTIC | House Type | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | % Change from 2022 |

| Charlottetown | Detached House | $147 | $165 | $178 | $211 | $245 | $235 | -4.08% |

| Fredericton | Detached House | N/A | $99 | $123 | $147 | $170 | $196 | 15.29% |

| Halifax | Detached House | $155 | $162 | $170 | $281 | $408 | $398 | -2.45% |

| Halifax | Condo | $228 | $239 | $270 | $291 | $450 | $467 | 3.78% |

| Moncton | Detached House | $101 | $106 | $124 | $142 | $173 | $197 | 13.87% |

| Saint John | Detached House | N/A | $111 | $123 | $134 | $163 | $192 | 17.79% |

| St. John’s | Detached House | N/A | $132 | $135 | $149 | $167 | $167 | 0.00% |

| St. John’s | Condo | N/A | $174 | $116 | $182 | $212 | $205 | -3.30% |

| PRAIRIES | House Type | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | % Change from 2022 |

| Regina | Detached House | $254 | $246 | $237 | $250 | $284 | $275 | -3.17% |

| Regina | Condo | $236 | $213 | $205 | $205 | $194 | $189 | -2.58% |

| Saskatoon | Detached House | $270 | $263 | $263 | $314 | $336 | $344 | 2.38% |

| Saskatoon | Condo | $208 | $213 | $217 | $216 | $219 | $226 | 3.20% |

| Winnipeg | Detached House | $282 | $243 | $244 | $293 | $315 | $291 | -7.62% |

| Winnipeg | Condo | $261 | $220 | $223 | $234 | $254 | $249 | -1.97% |

| Winnipeg | Attached | N/A | $202 | $210 | $241 | $269 | $258 | -4.09% |

| Brandon | Detached House | $248 | $246 | $248 | $271 | $276 | $276 | 0.00% |

| Brandon | Condo | $196 | $204 | $204 | $203 | $243 | $236 | -2.88% |

| ONTARIO | House Type | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | % Change from 2022 |

| Barrie | Detached House | $283 | $350 | $350 | $378 | $503 | $524 | 4.17% |

| Bradford | Detached House | $286 | $345 | $358 | $410 | $580 | $617 | 6.38% |

| Cambridge | Detached House | $332 | $355 | $388 | $450 | $625 | $670 | 7.20% |

| Cambridge | Duplex | $311 | $331 | $377 | $527 | $656 | $757 | 15.40% |

| Cambridge | Condo | $344 | $347 | $367 | $435 | $716 | $787 | 9.92% |

| Cambridge | Townhouse | $282 | $317 | $341 | $474 | $616 | $575 | -6.66% |

| Grey Bruce | Detached House | $175 | $182 | $195 | $357 | $455 | $434 | -4.62% |

| Guelph | Detached House | $397 | $409 | $443 | $483 | $690 | $527 | -23.62% |

| Guelph | Condo | $374 | $402 | $423 | $511 | $777 | $740 | -4.76% |

| Guelph | Duplex | $348 | $362 | $400 | $451 | $648 | $691 | 6.64% |

| Guelph | Townhouse | $311 | $335 | $364 | $433 | $641 | $605 | -5.62% |

| Hamilton | Detached House | $362 | $378 | $406 | $532 | $553 | $530 | -4.16% |

| Hamilton | Townhouse | $257 | $350 | $343 | $453 | $538 | $482 | -10.41% |

| Kitchener | Detached House | $339 | $359 | $400 | $430 | $618 | $610 | -1.29% |

| Kitchener | Semi-Detached | N/A | $341 | $399 | $460 | $623 | $632 | 1.44% |

| Kitchener | Townhouse | N/A | $323 | $342 | $435 | $576 | $583 | 1.22% |

| Kitchener | Condo | $328 | $362 | $399 | $483 | $800 | $838 | 4.75% |

| London | Detached House | $191 | $237 | $250 | $362 | $466 | $384 | -17.60% |

| Markham | Detached House | N/A | N/A | $485 | $557 | $685 | $753 | 9.93% |

| Niagara Falls | Bungalow | N/A | $336 | $395 | $475 | $630 | $746 | 18.41% |

| Niagara Falls | Detached House | N/A | $275 | $300 | $390 | $531 | $606 | 14.12% |

| Newmarket | Detached House | N/A | $372 | $510 | $505 | $516 | $536 | 3.88% |

| Ottawa | Detached House | $225 | $258 | $313 | $429 | $465 | $502 | 7.96% |

| Ottawa | Townhouse | N/A | N/A | N/A | $392 | $451 | $419 | -7.10% |

| Ottawa | Condo | $442 | $485 | $577 | $479 | $583 | $552 | -5.32% |

| Owen Sound | Detached House | $145 | $158 | $167 | $312 | $380 | $393 | 3.42% |

| Richmond Hill | Detached House | $445 | $465 | $522 | $520 | $665 | $717 | 7.82% |

| St. Catharines | Bungalow | $385 | $367 | $425 | $520 | $589 | $639 | 8.49% |

| St. Catharines | Detached House | $310 | $290 | $330 | $400 | $612 | $636 | 3.92% |

| Toronto, Downtown | Condo | $903 | $994 | $1,083 | $956 | $1,217 | $1,013 | -16.76% |

| Vaughn | Detached House | $434 | $503 | $548 | $612 | $695 | $687 | -1.15% |

| Waterloo | Detached House | N/A | $372 | $407 | $421 | $613 | $520 | -15.17% |

| Waterloo | Semi-detached | N/A | $357 | $399 | $439 | $648 | $663 | 2.31% |

| Waterloo | Townhouse | N/A | $324 | $344 | $408 | $641 | $651 | 1.56% |

| Waterloo | Condo | N/A | $402 | $411 | $503 | $777 | $831 | 6.95% |

| Windsor | Detached House | N/A | $372 | $407 | $295 | $306 | $469 | 53.27% |

| QUEBEC | House Type | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | % Change from 2022 |

| Montreal, Downtown and SW | Condo | $567 | $709 | $805 | $935 | $935 | $879 | -5.99% |

| Montreal, Downtown and SW | Detached House | $603 | $674 | $958 | $1,350 | $1,357 | $1,235 | -8.99% |

CENTURY 21 Canada raises $945,000 in support of Easter Seals Canada

Vancouver, BC (February 2023) – The partnership between CENTURY 21 Canada and Easter Seals Canada continues to be successful, with the legacy real estate brand raising just over $945,000 in support of the non-profit. This brings the total amount raised over the past 40+ years to more than $14 million dollars.

Since 1979, CENTURY 21 Canada has been fundraising for Easter Seals, primarily supporting their summer camp program for kids and teens living with disabilities in Canada. Many of the network’s agents build fundraising into their business, with a portion of each transaction going towards a donation. In 2022, the brand recognized 89 members of their ‘Golden Heart Club’– agents who raise a minimum of $2,100 towards Easter Seals, the second highest number to reach this distinction in its history.

First-time Golden Heart Winner Krista Trask from CENTURY 21 Seller’s Choice in St. Johns, NL, credits part of her fundraising motivation to her visits to Easter Seals summer camps. “When you see the kids at these camps, you remember just why it’s so important to support them,” says Krista. “It’s such a good cause and when you work in a community, it’s important to find ways to give back and turn your business success into something more.”

Alongside individual efforts, many offices across the country find ways to fundraise together, hosting annual events that have become beloved community traditions. Cam Toews from CENTURY 21 Westman Realty in Brandon, MB, is one of the longest-running Golden Heart winners, having spent more than eight years helping host the office’s annual bonspiel. “We’ve been really lucky that there are so many people and other businesses who come out to support us and support a great cause year over year. If anybody feels they want to try this themselves, all they have to do is reach out, find sponsors, and remember that you’re working towards a great goal, which is to help kids.”

“We’ve got a really great partner in Easter Seals and I am so proud that our network recognizes how important it is to give back,” says Brian Rushton, Chief Operating Officer of CENTURY 21 Canada. “We’ve been fortunate to have a strong real estate market for the past couple of years, and that’s meant a lot of success for our offices and agents. And with that success comes a responsibility to give back in some way, and Easter Seals is a great cause. We look forward to working with them for many years to come.”

CENTURY 21 Canada surpassed their original fundraising goal for 2022 of $750,000 by 26%. CENTURY 21 B.J. Roth Realty in Ontario held the title of top fundraising company for the year, and the network has set its sights higher with a 2023 fundraising goal of $800,000. To learn more about CENTURY 21 Canada’s partnership with Easter Seals, visit www.c21kidstocamp.ca

Despite Interest Rate Hikes, National Home Prices see Steady Rises across The Country in First Half of The Year

Vancouver (July 27, 2022) – While interest rates have been on the rise for the past few months, the Canadian housing landscape continued to see pricing growth during the first six months of this year. Prices were up particularly in suburbs and smaller communities outside metropolitan centres as more condo owners seek homes outside of the expensive Greater Toronto Area and Vancouver centres.

The sixth annual Price Per Square Foot survey released today by CENTURY 21 Canada shows that real estate continued to be a strong market for the first half of the year, with long-term growth continuing despite higher interest rates and concerns about what that will mean for the industry in the immediate future. While some markets have cooled after the boom that occurred during the COVID-19 pandemic, prices overall have continued to remain elevated for the start of the year.

In its annual, nationwide study, CENTURY 21 Canada compared the price per square foot of properties sold between January 1 and June 30 this year to the same period last year and in previous years.

“We recognize the concerns that some might have because of interest rates, but the first half of 2022 showed growth in nearly every regional market in the country,” says Brian Rushton, Chief Operating Officer of CENTURY 21 Canada. “The highest point of the boom may have passed, but the trend is still towards higher prices, especially in suburbs where younger and first-time home buyers are looking to escape competitive metropolitan areas now that remote work has become more common. What will be interesting is to compare the data we’ve received from the first half of this year with the data we gather in 2023 to see how the rising rates impact the market for the next six months.”

After high prices in January across the board, prices saw market-typical fluctuations throughout the spring, with most markets experiencing slight downturns in June when the rate hikes came into effect. However, that has not stopped the demand for housing, particularly in the communities of Hamilton, Kitchener and Cambridge in Ontario and communities such as Chilliwack and Kelowna in BC. Atlantic Canada has also continued a sharp upward trend, with Halifax condos seeing a 54 per cent price increase in the first half of the year. Though the market may see a downturn across the board in the next six months, prices in these fast-growing smaller cities will still likely see double-digit growth in 2023, continuing the upward pressure seen over the past five years.

Rushton says that market trends are evolving rapidly as the full effect of the rate changes will come into effect in the latter half of 2022. “We don’t want to get ahead of ourselves, we’re going to keep seeing how the market performs and whether or not it cools down after the frenzy of the past year. With inflation on the rise, folks may be less able to purchase but even a slight dip would only take us to the level of a few years back, possibly the 2018-2019 period. Ultimately, there are still buyers who have been waiting for a cool down period so that they can enter the market at the best time.”

Regional highlights:

Alberta

Moderate increases can be seen across regions in Alberta as investors from the GTA take advantage of growing smaller markets. While larger cities saw incremental growth, Okotoks and High River experienced double-digit increases, especially in their condo markets. The only decrease in this province can be found in St. Albert condos, though an increased PPSF in detached homes and duplexes indicate more families looking to grow in the suburbs.

Atlantic

Atlantic Canada was again a hot market this year for young and first-time buyers who have been unable to purchase in other, larger metros. Halifax condo prices continued their meteoric rise, with a heavy demand for detached homes not that far behind. Double-digit increases are seen throughout the region.

“Everyone is eager to find a place where they can put down roots, and once the remote work mandates from the pandemic became permanent, we haven’t seen any signs of this market slowing down in the first half of the year,” says David Yetman, Owner of CENTURY 21 All Points. “The biggest question for the next year will be if the supply can keep up with the demand. While prime interest rates have had a slowing effect, it is temporary, the current BoC rate is still extremely low and it bodes well for a healthy Halifax Regional Municipality (HRM) market going forward.”

British Columbia

Once again, BC real estate takes the top place as the most expensive market in the country, particularly in detached homes in Vancouver’s West Side. However, the high prices may see buyers moving away from the downtown core as condo prices have only seen a slight increase this year (though remains the second highest local market, with a PPSF of $1,283) while prices rose sharply in communities such as Kelowna and Chilliwack, where condos saw a 28 per cent and 35 per cent increase in price respectively in the first half of the year.

Quebec

The Montreal condo market has held steady over the past year, with no increase to their PPSF of $935/sf. With the change in interest rates, there is the possibility of younger buyers who have been looking east in the recent years choosing to remain in their home province should prices trend down.

“The next six months will be watched very carefully to see how buyers, especially younger buyers, react to the changing interest rates,” says Mohamad Al-Hajj, owner of CENTURY 21 Immo-Plus. “While some may wait to see if there are any more changes, other buyers may see an opportunity to not have to move away from their communities.”

Ontario

More buyers are leaving the Greater Toronto Area to seek homes in the communities such as Waterloo, Guelph and Hamilton. Guelph now stands at $777/sq ft, and Cambridge condos aren’t far behind at $716/sq ft.

Communities farther outside the GTA also saw substantial increases. Barrie saw a double digit increase in its detached home prices, as did Grey Bruce. As for the city of Toronto, after a slight downturn this time last year, prices have once agent risen to be the second highest in the country.

Prairies

The Prairies have seen a more modest growth in pricing than the rest of the country, but there have been rises across Manitoba and Saskatchewan. While Regina condo prices took a slight dip, the region’s detached homes are up by 13 per cent in the first six months of 2022. Winnipeg follows the trend, though at a lower growth rate of 11 per cent, and Saskatoon at seven per cent. Brandon may be an emerging market for younger buyers – while detached homes only saw a very slight single digit increase condos are up by nearly 20 per cent to $243/sq ft. Overall, prices in Prairie provinces have remained the steadiest over the past several years.

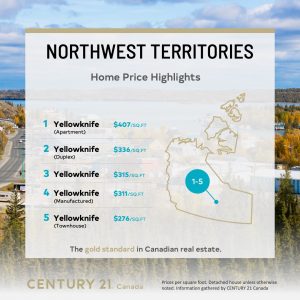

The upward trend of condos was even seen in Yellowknife, where a 14 per cent increase now sees the average apartment selling for $407/sq ft. More modest changes were seen across detached homes and townhouses, and only duplexes saw a small decrease.

CENTURY 21 Canada’s annual survey of data on the price per square foot (PPSF) of properties gathers and compares sales data from its franchises across Canada from January 1 to June 30 of each year. By looking at the price per square foot at the same time each year the firm is able to get a good idea of how prices have changed over time for similar properties. This year’s survey compares 2021 prices with this year’s results.

See full PPSF study results below:

ALBERTA |

|||||||

| CITY | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | % Change from 2021 |

| Calgary | House | $341 | $325 | $320 | $355 | $396 | 11.55% |

| Calgary | Condo | $329 | $317 | $296 | $303 | $326 | 7.59% |

| Edmonton | Detached House | $288 | $272 | $268 | $284 | $297 | 4.58% |

| Edmonton | Duplex | $275 | $256 | $250 | $270 | $287 | 6.30% |

| Edmonton | Condo | $231 | $220 | $206 | $217 | $222 | 2.30% |

| High River | Detached House | $193 | $215 | $237 | $271 | $307 | 13.28% |

| High River | Condo | N/A | $241 | $173 | $176 | $223 | 26.70% |

| Okotoks | Detached House | N/A | $238 | $254 | $283 | $338 | 19.43% |

| Okotoks | Condo | N/A | $254 | $211 | $219 | $251 | 14.61% |

| Red Deer | Detached House | $276 | $262 | $252 | $289 | $293 | 1.38% |

| Red Deer | Townhouse | N/A | N/A | N/A | $207 | $214 | 3.38% |

| Red Deer | Condo | N/A | N/A | N/A | $186 | $194 | 4.30% |

| Red Deer | Duplex | N/A | N/A | N/A | N/A | $269 | N/A |

| St. Albert | Detached House | $287 | $271 | $269 | $289 | $322 | 11.42% |

| St. Albert | Condo | $239 | $223 | $211 | $251 | $238 | -5.18% |

| St. Albert | Duplex | $262 | $272 | $278 | $280 | $325 | 16.07% |

BRITISH COLUMBIA |

|||||||

| CITY | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | % Change from 2021 |

| Chilliwack | Detached House | $297 | $294 | $288 | $406 | $515 | 26.85% |

| Chilliwack | Townhouse | $267 | $249 | $250 | $318 | $425 | 33.65% |

| Chilliwack | Condo/ Apartment | $283 | $290 | $270 | $351 | $473 | 34.76% |

| Kelowna | Detached House | $283 | $274 | $280 | $368 | $463 | 25.82% |

| Kelowna | Half Duplex | $247 | $260 | $263 | $320 | $402 | 25.63% |

| Kelowna | Townhouse | $292 | $287 | $302 | $365 | $452 | 23.84% |

| Kelowna | Apartment | $345 | $348 | $334 | $411 | $526 | 27.98% |

| Vancouver | Detached House | $856 | $769 | $816 | $975 | $1,177 | 20.72% |

| Vancouver, Downtown | Condo | $856 | $769 | $816 | $1,208 | $1,283 | 6.21% |

| Vancouver, East side | Detached House | $721 | $647 | $672 | $877 | $957 | 9.12% |

| Vancouver, West Side | Detached House | $1,147 | $990 | $1,004 | $1,208 | $1,421 | 17.63% |

| Burnaby | Detached House | $599 | $551 | $579 | $688 | $795 | 15.55% |

| West Van | Detached House | $899 | $738 | $734 | $971 | $1,038 | 6.90% |

| Vancouver, Richmond | Detached House | $677 | $598 | $608 | $722 | $831 | 15.10% |

| Delta North | Detached House | $423 | $400 | $413 | $570 | $716 | 25.61% |

| North Vancouver | Detached House | $681 | $613 | $690 | $794 | $910 | 14.61% |

| White Rock/South Surrey | Detached House | $506 | $472 | $435 | $625 | $795 | 27.20% |

| Victoria | Detached House | N/A | N/A | N/A | $558 | $592 | 6.09% |

| Victoria | Townhouse | N/A | N/A | N/A | $457 | $583 | 27.57% |

| Victoria | Condo | N/A | N/A | N/A | $659 | $676 | 2.58% |

ATLANTIC |

|||||||

| CITY | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | % Change from 2021 |

| Charlottetown | Detached House | $147 | $165 | $178 | $211 | $245 | 16.11% |

| Fredericton | Detached House | N/A | $99 | $123 | $147 | $170 | 15.65% |

| Halifax | Detached House | $155 | $162 | $170 | $281 | $408 | 45.20% |

| Halifax | Condo | $228 | $239 | $270 | $291 | $450 | 54.64% |

| Moncton | Detached House | $101 | $106 | $124 | $142 | $173 | 21.83% |

| Saint John | Detached House | N/A | $111 | $123 | $134 | $163 | 21.64% |

| St. John’s | Detached House | N/A | $132 | $135 | $149 | $167 | 12.08% |

| St. John’s | Condo | N/A | $174 | $116 | $182 | $212 | 16.48% |

PRAIRIES |

|||||||

| CITY | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | % Change from 2021 |

| Regina | Detached House | $254 | $246 | $237 | $250 | $284 | 13.60% |

| Regina | Condo | $236 | $213 | $205 | $205 | $194 | -5.37% |

| Saskatoon | Detached House | $270 | $263 | $263 | $314 | $336 | 7.01% |

| Saskatoon | Condo | $208 | $213 | $217 | $216 | $219 | 1.39% |

| Winnipeg | Detached House | $282 | $243 | $244 | $293 | $315 | 7.51% |

| Winnipeg | Condo | $261 | $220 | $223 | $234 | $254 | 8.55% |

| Winnipeg | Attached | N/A | $202 | $210 | $241 | $269 | 11.62% |

| Brandon | Detached House | $248 | $246 | $248 | $271 | $276 | 1.85% |

| Brandon | Condo | $196 | $204 | $204 | $203 | $243 | 19.70% |

ONTARIO |

|||||||

| CITY | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | % Change from 2021 |

| Barrie | Detached House | $283 | $350 | $350 | $378 | $503 | 33.07% |

| Bradford | Detached House | $286 | $345 | $358 | $410 | $580 | 41.46% |

| Cambridge | Detached House | $332 | $355 | $388 | $450 | $625 | 38.89% |

| Cambridge | Duplex | $311 | $331 | $377 | $527 | $656 | 24.48% |

| Cambridge | Condo | $344 | $347 | $367 | $435 | $716 | 64.60% |

| Cambridge | Townhouse | $282 | $317 | $341 | $474 | $616 | 29.96% |

| Grey Bruce | Detached House | $175 | $182 | $195 | $357 | $455 | 27.45% |

| Guelph | Detached House | $397 | $409 | $443 | $483 | $690 | 42.86% |

| Guelph | Condo | $374 | $402 | $423 | $511 | $777 | 52.05% |

| Guelph | Duplex | $348 | $362 | $400 | $451 | $648 | 43.68% |

| Guelph | Townhouse | $311 | $335 | $364 | $433 | $641 | 48.04% |

| Hamilton | Detached House | $362 | $378 | $406 | $532 | $553 | 3.95% |

| Hamilton | Townhouse | $257 | $350 | $343 | $453 | $538 | 18.76% |

| Kitchener | Detached House | $339 | $359 | $400 | $430 | $618 | 43.72% |

| Kitchener | Semi-Detached | N/A | $341 | $399 | $460 | $623 | 35.43% |

| Kitchener | Townhouse | N/A | $323 | $342 | $435 | $576 | 32.41% |

| Kitchener | Condo | $328 | $362 | $399 | $483 | $800 | 65.63% |

| London | Detached House | $191 | $237 | $250 | $362 | $466 | 28.73% |

| Markham | Detached House | N/A | N/A | $485 | $557 | $685 | 22.98% |

| Niagara Falls | Bungalow | N/A | $336 | $395 | $475 | $630 | 32.63% |

| Niagara Falls | Detached House | N/A | $275 | $300 | $390 | $531 | 36.15% |

| Newmarket | Detached House | N/A | $372 | $510 | $505 | $516 | 2.18% |

| Ottawa | Detached House | $225 | $258 | $313 | $429 | $465 | 8.39% |

| Ottawa | Townhouse | N/A | N/A | N/A | $392 | $451 | 15.05% |

| Ottawa | Condo | $442 | $485 | $577 | $479 | $583 | 21.71% |

| Owen Sound | Detached House | $145 | $158 | $167 | $312 | $380 | 21.79% |

| Richmond Hill | Detached House | $445 | $465 | $522 | $520 | $665 | 27.88% |

| St. Catharines | Bungalow | $385 | $367 | $425 | $520 | $589 | 13.27% |

| St. Catharines | Detached House | $310 | $290 | $330 | $400 | $612 | 53.00% |

| Toronto, Downtown | Condo | $903 | $994 | $1,083 | $956 | $1,217 | 27.30% |

| Vaughn | Detached House | $434 | $503 | $548 | $612 | $695 | 13.56% |

| Waterloo | Detached House | N/A | $372 | $407 | $421 | $613 | 45.61% |

| Waterloo | Semi-detached | N/A | $357 | $399 | $439 | $648 | 47.61% |

| Waterloo | Townhouse | N/A | $324 | $344 | $408 | $641 | 57.11% |

| Waterloo | Condo | N/A | $402 | $411 | $503 | $777 | 54.47% |

| Windsor | Detached House | N/A | $372 | $407 | $295 | $306 | 3.73% |

QUEBEC |

|||||||

| CITY | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | % Change from 2021 |

| Montreal, Downtown and SW | Condo | $567 | $709 | $805 | $935 | $935 | 0.00% |

| Montreal, Downtown and SW | Detached House | $603 | $674 | $958 | $1,350 | $1,357 | 0.52% |

NORTHWEST TERRITORIES |

|||||||

| CITY | HOUSE TYPE | 2018 | 2019 | 2020 | 2021 | 2022 | % Change from 2021 |

| Yellowknife | Detached House | N/A | N/A | $277 | $312 | $315 | 0.96% |

| Townhouse | N/A | N/A | $265 | $260 | $276 | 6.15% | |

| Manufactured | N/A | N/A | $267 | $290 | $311 | 7.24% | |

| Apartment | N/A | N/A | $347 | $357 | $407 | 14.01% | |

| Duplex | N/A | N/A | $306 | $343 | $336 | -2.04% | |

View Pirce Per Square Foot 2021 and Price Per Square Foot 2020

How the information was gathered by CENTURY 21 Canada

CENTURY 21 franchisees were asked to help come up with the average price-per-square-foot in their market. However, calculating a precise number is not an exact science as every office and province tracks statistics slightly differently. As a result, most have used the median price and square footage in their market in sales from January 1 – June 30, 2022. Each franchisee has confirmed that the numbers provided are an accurate representation of the trends market.

For more information please contact:

Peak Communicators

Shawn Hall

Phone: (604) 619-7913

Email: shawn@apogeepr.ca

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link